- Home

-

About

Fidelity & Excellence

Fidelity & ExcellenceThomas Aquinas College is unique among American colleges and universities, offering a faithfully Catholic education comprised entirely of the Great Books and classroom discussions.

-

A Liberating Education

Truth Matters

Truth MattersTruth, and nothing less, sets men free; and because truth is both natural and supernatural, the College’s curriculum aims at both natural and divine wisdom.

-

A Catholic Life

Under the Light of Faith

Under the Light of FaithThe intellectual tradition and moral teachings of the Catholic Church infuse the whole life of Thomas Aquinas College, illuminating the curriculum and the community alike.

-

Admission & Aid

Is TAC Right for You?

Is TAC Right for You?Do you enjoy grappling with complex questions? Are you willing to engage in discussions about difficult concepts, with the truth as your ultimate goal?

-

Students & Parents

Mind, Body & Spirit

Mind, Body & SpiritThere is always something to do at TAC — something worthwhile, something fulfilling, and something geared toward ever-greater spiritual and intellectual growth.

-

Alumni & Careers

What Can You Do with a Liberal Education?

What Can You Do with a Liberal Education?Nothing speaks more to the versatility of the College’s academic program than the good that our alumni are doing throughout the Church and the world.

- Search

- Giving

Brian Dragoo: “Pascal’s Wager: A Gambler’s Commentary”

By Brian Dragoo

Tutor Talk

Febuary 12, 2025

Setting the Scene

The text under consideration today, commonly known as “Pascal’s Wager,” is found among the fragmentary texts published posthumously under the title Pensées, or Thoughts. Though it is thought that Pascal was assembling these fragmentary texts to be published eventually as a text presenting and apology for the Christian religion, he died before he was able to accomplish this. The Pensées was first assembled, ordered, and published in 1670, eight years after his death, but through the years scholars have disagreed about the order in which they should be read, and therefore they have been published in several different orders in various editions through the years.

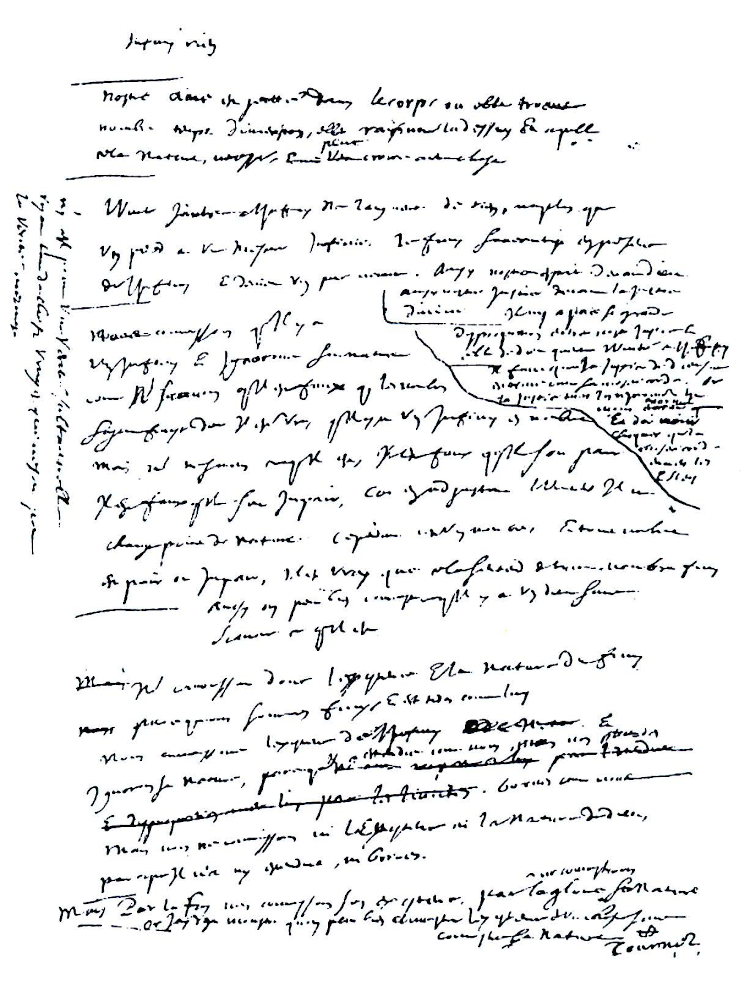

The fragment that has come to be called the “Wager” is known by scholars as the “Infini–rien” fragment, which are its first words: “Infinity–nothing.” This fragment is described by Canadian philosopher of science Ian Hacking in 1972 as consisting of “two pieces of paper covered on both sides by handwriting going in all directions, full of erasures, corrections, insertions, and afterthoughts.”1

Here at the college, we read this text in the junior seminar in the context of the Pensées as a whole, which, in the Penguin edition, is roughly 220 pages total, of which the Wager is only five. We also introduce it to high school students in our two-week summer program, where we read only the Wager in isolation as a standalone text. The fact that we are able to introduce it to such relatively unformed minds is a sign that its overall sense is not too difficult to grasp.

In my experience, however, I have always found it difficult to engage in a detailed analysis of the Wager with either group of students. The difficulty in the junior seminar arises by the fact that we don’t have the luxury of spending a great deal of time on it because there are so many other parts of the Pensées to discuss that there is not time to engage in a close reading of just this one part. In the high school program the difficulty arises because, though high schoolers can grasp the overall idea of the text, they are not yet intellectually disciplined enough to engage in a close reading.

For these reasons, whenever I have read this the Wager with students, I have oscillated between thinking that the argument does not really hang together as a whole, on the one hand, and feeling like I am just on the cusp of understanding it, on the other. In popular presentation, the argument is usually reduced to something like a four-box decision matrix; if you have every read about this text you have probably seen something like it.2 I find that approach to be a bit reductionist, and I have always been motivated to look more carefully at exactly what he says and how he says it, in order to understand him better. This year I finally took the time to do so, and this talk is the result. Since it is only meant to be 30 minutes or so, I do not pretend to say everything that might be said about this text.

I certainly don’t have time to engage the Pensées as a whole, nor will I have time to read through the whole section under the heading of “Infinity—nothing.” I will have just enough time to work through the part that comprises the central part of the argument which he puts in terms of the mathematics of wagering. I will read through that part line-by-line, or at least thought by thought, in the manner of a traditional commentary. And since I am coming at the text with some background in probability theory, as well as some real world experience with the decision making of a gambler, I have entitled the talk “Pascal’s Wager, A Gambler’s Commentary.”

My thesis is that his argument from the expected value of the decision does hang together when its terms are understood, at least as far as it goes, but that it is also open to several objections as well, of which I will highlight what I think is the most damaging one.

The Existence of God

When presented in an introductory survey of philosophy, the Wager is often discussed alongside arguments for God’s existence, like Anselm’s “Ontological Argument,” and St. Thomas Aquinas’ five ways. It makes some sense, I suppose, to think of the Wager in this general context, since Pascal says in his introductory remarks, “Let us then examine the point, and let us say: ‘Either God is or he is not.’ But to which view shall we be inclined?” So at least the general theme is one of the question of God’s existence. But his approach is not one of proof or demonstration, as becomes evident when he immediately follows the above question by saying that “reason cannot decide this question.”

He says this because just before having introduced the question of God’s existence, he had said that,

We do not know either the existence or the nature of God, because he has neither extension nor limits…. If there is a God, he is infinitely beyond our comprehension, since, being indivisible and without limits, he bears no relation to us. We are therefore incapable of knowing either what he is or whether he is. That being so, who would dare to attempt an answer to the question? Certainly not we, who bear no relation to him.

Now, this does not mean that he has nothing more to say about the question. He ultimately seems to want to convince his reader in this fragment that is reasonable to believe in God, or at least that it is reasonable to live the life of one who believes. But what is his approach, if he does not think it possible to prove the existence of God? Well, his next line tells us:

Infinite chaos separates us. At the far end of this infinite distance a coin is being spun which will come down heads or tails. How will you wager? Reason cannot make you choose either, reason cannot prove either wrong.

So, we need to make a decision, but “reason cannot make [us] choose.” So what is left? It seems that he has already hinted at approach by his introduction of the metaphor of the coin: he will address the decision through a game of chance.

We all know that Pascal was a polymath, i.e., someone with advanced knowledge across many fields of study, including philosophy, theology, physics, and mathematics, so his interests and his influence were quite broad. He is even said to be the inventor of modern public transportation, having designed a system of carriages that ran throughout Paris on a regular schedule, the first of its kind. And of course we encounter some of his mathematical works here at the college: his contributions to the use of the binomial theorem gave his name to what we now call Pascal’s triangle (though he did not discover it), and in the past we used to read his treatise on projective geometry in Senior Math, which was a work that gave further insight into the properties of conic sections beyond what we learn from Apollonius and Descartes.

More relevant to today’s subject, Pascal was a pioneer in probability theory. He used to correspond with his friend Fermat, another famous mathematician of the time, about decision-making problems faced by professional gamblers. So, in this work, the Wager, Pascal finds an application of the mathematics of probability to one of life’s ultimate decisions: whether to live a life that reflects belief in God. In other words, in Pascal’s mind, where traditional proofs of God’s existence could only fail to convince the mind, an appeal to the reasoning of a gambler might produce results.

An Introduction to Expected Value

So, Pascal is directing his argument to those who might be able to think like gamblers. But how do gamblers think? And why is this an appropriate way to approach the problem of God’s existence? First, we’ll need a little primer in gambling theory to understand the components that go into making decisions like those faced by gamblers.

The first thing to recognize is that professional gamblers think about betting a little differently from your average guy on a bachelor party trip to Vegas. Professional gamblers are not looking to get lucky in a few hours at the roulette table over a weekend visit; they are looking to make decisions that are guaranteed to be profitable to them in the long run. But this presents a problem: how can something that depends on uncertain outcomes, like dice or cards, be knowable? A statement about future continent things can be neither true nor false, so what sort of knowledge can there be about such things that allows us to make decisions in the present? This is the kind of thinking that Pascal wants to take advantage of in application to the problem of belief.

A Simple Flip of a Coin

Now, the mathematics of gambling theory is not really all that difficult. If you have every played a game of cards for money, or especially if you have bet on horses or sports, you have certainly encountered at least the basics of the mathematics of decision making. You experienced poker players might find this first little section far too basic, but in my experience reading Pascal’s Wager in the classroom is that most of our students are not trained to think in this way, so my plan here is to introduce the concepts slowly, and from the very beginning. After establishing some basics, I’ll begin to comment on Pascal’s application of them.

Let’s start very very simple here, and describe a situation before introducing any technical language or mathematics. Suppose two friends are betting on the outcome of the simplest possible event: a coin flip. There are two players, Andy and Bob, and two outcomes, heads and tails.3 Suppose Andy bets on heads, Bob on tails, and suppose further that they each bet the same amount: each player puts one dollar into the “pot,” which equals a total of two dollars.4 At this point we have a bet, or a “wager,” and the result of the coin flip will determine who receives the contents of the pot.

Because this is such a simple wager, we really don’t need much probability theory to work things out. If we presume the coin is fair, and landing on its edge after the flip is impossible (or statistically negligible) it has an equal likelihood of landing on heads and tails. If we flip the coin, and it lands on heads, Andy wins the $2 pot (for a total win of $1), and Bob wins nothing, for a total loss of $1.

Notice this: if we ended things there, i.e., only flipped the coin once, then we wouldn’t have much to talk about. One man would win, the other would lose, and we’d all go home. Remember, however, that Pascal developed this mathematics for professional gamblers, who (by definition) always have a next bet, i.e., they don’t quit when ahead or behind in the short run; it is their livelihood to realized their expectation in the long run.

So Andy and Bob, being gamblers, of course, make another bet. They each wager another dollar, creating another $2 pot, and flip the fair coin again. Suppose this time it lands on tails: now Bob wins the $2 pot (for a $1 profit) and Andy loses his $1 stake for a net loss of $1. But we’re not done: after each flip of the coin we can calculate their total amount won or lost to date. So after two coin flips, Andy and Bob have each staked a total of $2, and have each won one $2 pot, thus both have broken even over the two flips of the coin.

But they are gamblers, and don’t quit after two flips, so let’s say they keep going to a total of ten. We can intuit that the most likely result after ten flips is likely to be the same as the result after the first two flips. That is, the coin will produce 5 heads and 5 tails, and the two men will break even. Now, we can also intuit that an even outcome is not necessary in ten flips, even with a fair coin; there’s no guarantee that things will come out 5 heads and 5 tails. It’s possible for a fair coin to land on heads 3 or 4 or 6 or 7 times out of 10, or any other number for that matter. But it is a principle of probability that as the number of events increases, the ratio of the number of one outcome to the total number of events will approach the material probability assigned to that event. So that’s our first thing to grasp: if the material likelihood of the coin flip is equal for each outcome,5 then as the number of flips gets very large, the number of outcomes on each side will approach equality.6

Ok, so if our gamblers continue flipping the coin, always presuming a fair coin, a hundred or a thousand or a million times, the more they play, the more they can “expect” to break even. Here we introduce the language of the “expectation" or “expected value” of the wager as that value which belongs to each flip of the coin as a percentage of a large number of repeated flips.

Varying the Odds

Now so far, our example is quite boring and unrealistic. No real gambler would waste his time in this way, making even money bets on coin flips, because he did not get into gambling to break even. Suppose Andy is a professional, and he knows Bob just gambles for the thrill of it, and loves to bet big. Andy appeals to Bob’s love of big bets to convince his friend to wager $2 on every flip, while Andy himself is allowed to continue to wager $1. So they stake their wagers, and now the pot is $3, two from Bob and one from Andy. And suppose the first flip comes up tails. Bob wins! And he’s excited, because under the old wager, he would have won only $2, but this time he won $3! And suppose they flip a second time, and it comes up tails again! Bob is doing great!

But again, we can see without too much calculation, that even though Bob got lucky in getting tails on the first few flips, that his “expected value” here is negative. This is what we mean by EV: it is the rate of win that is approached as the number of occurrences of the event increases. So even though Bob started out on a little hot streak by winning the first two flips, if they continue to flip the coin a thousand times, Bob is statistically guaranteed (or very nearly so) come out a loser, despite his early luck.

In fact we can calculate Bob’s EV exactly with some simple math: For each flip of the coin, there is $3 in the pot to be won. On average, the coin will come up tails 1 time out of every 2 flips, or 50% of the time. That means that 50% of every pot, or $1.50 (again, on average, in the long run) will go to Bob. But remember that Bob has put in $2 for every flip, so even if he wins some times (which he will of course), on average he loses $0.50 for every coin flip, so we say that his EV or expectation8 is −$0.50. And with the same math we can see that Andy’s EV or expectation on each flip is +$0.50.

This very simple example should give us the tools and terminology to analyze any simple wager. Let’s look at the components of a wager, and introduce some more technical language. Every wager has the following components:

-

An “event” with uncertain outcomes;

-

Determined likelihoods of each outcome, what I will call the “event odds”;

-

A stake, or amount wagered by each player, which form what I will call the “money odds” or “pot odds”’

-

And therefore every wager has an expected value, which is (in theory) calculable.

Notice right away that we have two different things that I’m calling “odds”. We have likelihood of a particular outcome, which can be expressed in terms of a ratio of likelihoods, which is what I’m here calling the “event odds.” We also have the ratio of money wagered, or stakes which is what I’m here calling the “ money odds.”

In our simple two-player coin flip, we can identify these two kinds of odds. And notice there are a couple of ways to express these ratios: Since the “event” (i.e., the flip of a fair coin) has two outcomes, and the outcomes are equally likely, I could say that the event odds are 50–50, or 1 : 1. But for reasons that will become clear, I will define the event odds as the ratio between all possible outcomes and one of the possible outcomes. So we will present Andy’s event odds (heads) as 2 : 1, meaning two possible outcomes, one of which is Andy’s (and the same for Bob).

For similar reasons, I will also define the money odds or pot odds as the ratio between the total amount staked by all players, i.e., the money in the pot, to the amount staked by one player. So the money odds for each player in my first coin flip example was also 2 : 1, which is the ratio of the amount of money the pot, or total money to be won, to the amount staked by each player. In my second example, Andy was getting 3 : 1 money odds, while Bob was getting 3 : 2.

Again we can intuit that when the money odds exceed the event odds, the player has a positive expectation, or is “+EV”, and when the odds are reversed, the player has a negative expectation or is “−EV”. This is at the heart of the matter here: the entire aim of a professional gambler is to put himself in +EV situations, because if he could so with regularity in all of his gambling engagements, he would be guaranteed to be profitable in the long run.

Even More Complexity

Notice that we can add complexity to our event without really changing the way the math is calculated at all. Suppose Andy and Bob get tired of the two-outcome tedium of flipping coins, and want to move on to rolling dice. Andy bets Bob that a six will come up on the die, and gives Bob all the rest of the numbers. Bob is clearly going to win, right? Because he has many more outcomes in his favor? Well, you don’t have all the information yet: how much are they staking? Andy being the clever one, sets the stakes: and he tells Bob that he is willing to wager $1 per roll, if Bob, who loves the thrill of a bigger pot to be won, would wager $6. Andy will lose five rolls out of every six on average, but when his number six comes up, he will win a 7 pot after having bet only $1. In the long run, we can calculate Andy’s EV by the same method as the coin flip: we see that the pot for every roll is $7, and Any will win 1/6 of the time, so his EV is 7/6 dollars or about +$1.17. Since he is only risking $1 per roll, he has an EV of +$0.17, and Bob has a corresponding negative EV.

I can do the same thing for this 60-sided die here. Andy bets $1 that the die will land on the number 60, and Bob gets the rest of the numbers, so long as he is willing to bet $60. Each pot is now $61, and most of the time, Bob will win, and will be very happy with himself; he loves to win. But Andy will win that $61 pot 1/60 of the time, which puts his EV at just under $0.02 per roll. It’s not much, and he will lose most rolls, but as long as they keep playing at these odds for a long time, the math guarantees that he will win more than he loses.

This is what makes decisions to enter into such gambling situations to be called “correct”, and it is why Pascal will use the language of “right” and “wrong” (if we ever get to his text). The single thing that defines the professional gambler, as such, is that he identifies betting situations that have a positive expectation, making it the “right” or “correct” decision to wager.

Real Gamblers

One last thing before we turn to Pascal. It might seem unlikely to us that Andy could convince someone like “Bob” to give him favorable odds on a simple coin flip or roll of the dice like we’ve described. But this is precisely how casinos operate: they prey upon the passions, they give players an apparently attractive proposition, but then design their games so that they always have slightly positive expectation, not much different in principle from what we saw with Andy and Bob, so that in the long run they are in Andy’s position, and are guaranteed to come out ahead.

Individual professional gamblers generally avoid these standard games run by a casino (like roulette or slots), and direct their attention to finding situations where they are the ones with the positive expectation. This might be anything from learning something about how racehorses are bred and trained, to identifying favorable odds at a in a team sports event, to finding lucrative poker games populated with bad players. The calculation of expected value gets a bit more complicated than my coin and dice examples when you’re betting on things like horses and sports and poker, because the the event odds are not always as well known as they are with coins and dice. I don’t have time to talk about how that all works, but it’s quite fascinating, and the general principles are just the same. And please, note that I am not advocating any of this, just trying to lay out the basic math of how it all works.

The Commentary

Now we should be prepared to return to Pascal. In the remainder of this talk, I comment on the probability-based portion of the Wager from the perspective of the gambler to whom Pascal is addressing his argument. The mode of my presentation is to read a section of the text, then to explain what I think is going on.9

Yes, but you must wager. There is no choice, you are already committed. Which will you choose then? Let us see: since a choice must be made, let us see which offers you the least interest.

Pascal begins by responding to an objection from his interlocutor that in the matter of belief in God, the correct decision is not to “wager.” The interlocutor said, “I will condemn [men] not for having made this particular choice, but any choice, for, although the one who calls heads and the other one are equally at fault, the fact is that they are both at fault: the right thing is not to wager at all.” Presumably the opponent is advocating some sort of agnostic position, but Pascal reminds him that the issue at hand is not one of intellectual assent or not to the existence of God, but rather one of how one must decide to live. Since you are alive (i.e., “already committed”), you must live in a certain way. There is no opting out, so we must decide which choice is preferable.

You have two things to lose: the true and the good; and two things to stake: your reason and your will, your knowledge and your happiness; and your nature has two things to avoid: error and wretchedness. Since you must necessarily choose, your reason is no more affronted by choosing one rather than the other. That is one point cleared up. But your happiness? Let us weigh up the gain and the loss involved in calling heads that God exists.

Here Pascal begins to put the decision in terms familiar to the gambler: “loss” and “stake”. He sets up a series of parallel things of value: one group on the side of our knowing power, the other on the side of our desiring power. The true, knowledge, reason, error on the one hand, and the good, will, happiness, wretchedness on the other. He says that however we decide, our reason will not be offended, since he has already established that we cannot reason either way on the question, that is, we cannot prove God’s existence with human reason. Therefore the gambler has only to concern himself with matters of the good: will, happiness, and wretchedness.

Let us assess the two cases: if you win you win everything, if you lose you lose nothing. Do not hesitate then; wager that he does exist. “That is wonderful. Yes, I must wager, but perhaps I am wagering too much.” Let us see: since there is an equal chance of gain and loss, if you stood to win only two lives for one you could still wager…

Notice that Pascal is identifying the essential elements of the wager that we have already introduced, and that his audience (the gambler) will recognize immediately:

-

The “event” with uncertain outcome: whether God exists, or perhaps more crucially, how he will spend eternity based upon his decision;

-

The event odds: He assumes here that our situation is like that of a coin flip, i.e. a situation with two outcomes that have equal chances;10

-

The money odds.

What does he mean here by “win” and “lose”? He tells us in the next sentence: “wager that he exists.” What does it mean to wager that he exists? It means to live the life of a believer.11 This is why he puts the “stake” of the wager in terms of “lives.” To wager that God exists means to give up a life displeasing to God, should he exist, and to live a life pleasing to him. So the stake is your life, or at least, your lifestyle.

When he says, “if you stood to win only two lives for one you could still wager,” he is saying that the event odds and the money odds are the same. That is, because we are betting on an event that is just the same as a coin flip, the event odds are 2 : 1, i.e., two possible outcomes, one of which is a win for you. We already saw that if you wager on a coin flip, and you are getting 2 : 1 on your money, it is by the gambler’s calculus an EV-neutral decision.12 And when he says “you could still wager”, he is speaking in terms of the gambler’s logic.

…but supposing you stood to win three? You would have to play (since you must necessarily play) and it would be unwise of you, once you are obliged to play, not to risk your life in order to win three lives at a game in which there is an equal chance of losing and winning. But there is an eternity of life and happiness.

And so when he continues on saying, “supposing you stood to win three?” he is making an argument a fortiori. Remember that to be profitable, the gambler must be able to identify the three possible situations: −EV, EV-neutral, or +EV. The gambler, as such, must not ever wager when the expectation is negative, he can wager (or not) when expectation is neutral and he must wager when expectation is positive. This is central to the what it is to be of a gambler: to put oneself into the profitable, or +EV side, of a wager. And when a gambler finds a +EV situation, he “must,” as a gambler, take the bet.

Pascal has already identified the situation where “you stood to win only two lives” as an EV-neutral proposition, where the gambler could wager, so he simply increases the money odds by one unit, supposing that you could win three lives. Any situation in which the money odds are greater than the event odds has a positive expectation, and therefore he says (to his gambler) that, “you would have to play.” And then he restates his reasoning: “it would be unwise of you…not to risk your life in order to win three lives at a game in which there is an equal chance of losing and winning.” Here he is saying what we’ve been saying all along: when the money odds exceed the event odds, it would be “unwise” not to take the risk, according to the wisdom of the gambler.

He then increases his argument a fortiori again, saying that the actual money odds are not 2 : 1, not 3 : 1, but infinity to one, as it were, since what you stand to gain is no simple multiple of what you are risking, but infinite.

That being so, even though there were an infinite number of chances, of which only one were in your favor, you would still be right to wager one in order to win two; and you would be acting wrongly, being obliged to play, in refusing to stake one life against three in a game, where out of an infinite number of chances there is one in your favor, if there were an infinity of infinitely happy life to be won.

Here he makes a couple of strange moves. When he says “even though there were an infinite number of chances, of which only one were in your favor,” he seems to be supposing that we are playing a different game than the coin flip we were working with before. Remember our example of the roll of a die from earlier. If you bet on one number, you might describe that game as having “six chances, only one of which is in your favor.” Or if we bet one number on the roll of our 60-sided die, we could describe the game as having “sixty chances, only one of which is in your favor.

So here he has elevated the game from a flip of a coin (two chances, one of which is in your favor) to an infinity-sided die, where you have to choose one outcome from “an infinite number of chances.” And he says “you would still be right to wager” on these odds, which we might describe as “infinity to one”, because the prize for winning should your number come up is of infinite worth. He states his case even stronger, saying “you would be acting wrongly in refusing” to wager.13

A second strange move is that he says that what we stand to win is “an infinity of infinitely happy life.” So not only are there an infinite number of lives to be won (whatever that would mean), the quality of that life is infinitely happy. I suppose this is why he says it would be wrong not to wager, because remember, if the event odds and money odds are equal, the gambler could play or not. So if we have infinity to one odds, and we stand to win infinity, that would be sort of like having two to one odds, and standing to win two, i.e, a breakeven bet. But by adding a qualitative element, he must think that he is pushing the wager from breakeven to +EV.

But here there is an infinity of infinitely happy life to be won, one chance of winning against a finite number of chances of losing, and what you are staking is finite. That leaves no choice; wherever there is infinity, and where there are not infinite chances of losing against that of winning, there is no room for hesitation, you must give everything. And thus, since you are obliged to play, you must be renouncing reason if you hoard your life rather than risk it for an infinite gain, just as likely to occur as a loss amounting to nothing.

Here he keeps the money odds the same (we still have an “infinity of infinitely happy life to be won”, but dials back the event odds, reminding us that our bet on God’s existence is still only a coin flip. That is, we really aren’t rolling an infinitely sided die, but just betting on one of only two possible outcomes. So in gambling terms we are getting infinity to one on our money on a 2 : 1 proposition. Given those odds, the gambler is obliged to bet. This concludes the above line of argumentation.

For it is no good saying that it is uncertain whether you will win, that it is certain that you are taking a risk, and that the infinite distance between the certainty of what you are risking and the uncertainty of what you may gain makes the finite good you are certainly risking equal to the infinite good that you are not certain to gain.

Here, Pascal puts forward an objection that might be raised. It seems to be the objection of anyone who is averse to the risks associated with gambling. Someone like this might argue that they have a certain good in hand, and by the very fact that the proposition of winning is uncertain, it does not matter whether what they stand to win is infinitely good, because the “distance” between certainty and uncertainty is the same as the difference between the finite good that they currently have and the infinite good that they are not certain to win. Well, this just isn’t the way gamblers reason. Listen to how he answers the objection:

This is not the case. Every gambler takes a certain risk for an uncertain gain, and yet he is taking a certain finite risk for an uncertain finite gain without sinning against reason. Here there is no infinite distance between the certain risk and the uncertain gain: that is not true. There is, indeed, an infinite distance between the certainty of winning and the certainty of losing, but the proportion between the uncertainty of winning and the certainty of what is being risked is in proportion to the chances of winning or losing. And hence if there are as many chances on one side as on the other you are playing for even odds. And in that case the certainty of what you are risking is equal to the uncertainty of what you may win; it is by no means infinitely distant from it. Thus our argument carries infinite weight, when the stakes are finite in a game where there are even chances of winning and losing and an infinite prize to be won.

Pascal answers the objection by saying that uncertainty is part of every wager. And we have already shown through our analysis of expected value, that even though the gambler risks losing his stake in any one wager, he will win in the long run when the money odds exceed the event odds. And he has shown that to be the case with this particular wager, so the objection does not stand.

This is conclusive and if men are capable of any truth this is it.

Here Pascal has concluded his case.

A Serious Objection

Many scholars have made many of the possible objections to this sort of argument. I will raise the one that strikes me specifically in the context of the decision making of the gambler. Something that often gets overlooked in the calculus of expectation is a concept called “Risk of Ruin”.14 Remember that the argument from expected value depended upon something very important, i.e., the event odds of any given outcome approach the probability of that event as the number of instances of the event increases. That is, the professional gambler is able make decisions based on expected value not because he expects to win every time he plays, but because a property of any situation that has been determined to be +EV, is that every time he wins, he wins enough to cover the times that he loses, and more besides. (Remember the coin flip.)

A hidden premise, then, of every calculation of expected value is that there must be enough future events at the same expected value so that the actual event outcomes can approach the limit of the probability of the event. Here’s what I mean: Suppose we go back to Andy and Bob and their uneven coin flip bet. Andy wagers $1, Bob wagers $2, the coin flip is 50–50, and so Andy has a positive expectation of +$0.50, and Bob has the corresponding negative expectation of −$0.50. Remember that to calculate this we had to suppose that the two men were willing to flip a coin not just once, not just ten times, but a hundred or a thousand or more times in order to make that claim about EV.15

Suppose we make one minor alteration: instead of asking Andy to wager $1, Bob asks Andy to wager $1 million, his entire net worth. Bob will still offer to double Andy’s wager, so Bob will bet $2 million,16 so the EV calculation is exactly the same: Andy is getting 3 : 1 on his money for a coin flip, which is a 2 : 1 proposition. In any situation of positive expected value, Pascal reminds us that a gambler is obliged to wager, remember? But now, since Andy is being asked to risk his whole net worth, his entire bankroll, if the coin flip happens to fall on tails, Bob will win, and Andy will have no more money left with which to recoup his losses in future wagers. Therefore, EV cannot not the only factor in making gambling decisions.

Pascal seems to be making this mistake here. He is asking his gambler to make a decision using the calculation of expected value, but failing to take account of the risk of ruin. If his gambler bets his life, that is, bets all he has, on God’s existence and loses, even if his EV is positive for that decision, he will not have a chance to realize that expectation in future gambling events, because this is a one time offer, and by definition, gambling decisions depend upon the ability to multiply events.

Conclusion

Now, it is entirely possible that Pascal saw this objection, and intended to deal with it before his work was published. To my mind, if his argument contained nothing but the gambler’s analysis, we must conclude it to be a failure. But something he says as he is wrapping up the Wager might be placed here just to mitigate his argument somewhat:

Now what harm will come to you from choosing this course? You will be faithful, honest, humble, grateful, full of good works, a sincere, true friend…. It is true you will not enjoy noxious pleasures, glory and good living, but will you not have others?

I tell you that you will gain even in this life, and that at every step you take along this road you will see that your gain is so certain and your risk so negligible that in the end you will realize that you have wagered on something certain and infinite for which you have paid nothing.

Here he says that the life lost by betting on the existence of God, which, remember, would giving up pleasure, glory, wealth, is not really a loss at all, even if God does not exist. In fact, life without pursuing these so-called goods is even better! But this seems to me a bit like gambling with monopoly money. If there really is nothing to lose, and all the more if what you think is a loss is really a win, then I wonder if there really was any need for the gambling analysis at all.

Handout: Pascal’s Wager

The Central Argument from Expectation

Yes, but you must wager. There is no choice, you are already committed. Which will you choose then? Let us see: since a choice must be made, let us see which offers you the least interest.

You have two things to lose: the true and the good; and two things to stake: your reason and your will, your knowledge and your happiness; and your nature has two things to avoid: error and wretchedness. Since you must necessarily choose, your reason is no more affronted by choosing one rather than the other. That is one point cleared up. But your happiness? Let us weigh up the gain and the loss involved in calling heads that God exists.

Let us assess the two cases: if you win you win everything, if you lose you lose nothing. Do not hesitate then; wager that he does exist. “That is wonderful. Yes, I must wager, but perhaps I am wagering too much.” Let us see: since there is an equal chance of gain and loss, if you stood to win only two lives for one you could still wager…

…but supposing you stood to win three? You would have to play (since you must necessarily play) and it would be unwise of you, once you are obliged to play, not to risk your life in order to win three lives at a game in which there is an equal chance of losing and winning. But there is an eternity of life and happiness.

That being so, even though there were an infinite number of chances, of which only one were in your favor, you would still be right to wager one in order to win two; and you would be acting wrongly, being obliged to play, in refusing to stake one life against three in a game, where out of an infinite number of chances there is one in your favor, if there were an infinity of infinitely happy life to be won.

But here there is an infinity of infinitely happy life to be won, one chance of winning against a finite number of chances of losing, and what you are staking is finite. That leaves no choice; wherever there is infinity, and where there are not infinite chances of losing against that of winning, there is no room for hesitation, you must give everything. And thus, since you are obliged to play, you must be renouncing reason if you hoard your life rather than risk it for an infinite gain, just as likely to occur as a loss amounting to nothing.

For it is no good saying that it is uncertain whether you will win, that it is certain that you are taking a risk, and that the infinite distance between the certainty of what you are risking and the uncertainty of what you may gain makes the finite good you are certainly risking equal to the infinite good that you are not certain to gain.

This is not the case. Every gambler takes a certain risk for an uncertain gain, and yet he is taking a certain finite risk for an uncertain finite gain without sinning against reason. Here there is no infinite distance between the certain risk and the uncertain gain: that is not true. There is, indeed, an infinite distance between the certainty of winning and the certainty of losing, but the proportion between the uncertainty of winning and the certainty of what is being risked is in proportion to the chances of winning or losing. And hence if there are as many chances on one side as on the other you are playing for even odds. And in that case the certainty of what you are risking is equal to the uncertainty of what you may win; it is by no means infinitely distant from it. Thus our argument carries infinite weight, when the stakes are finite in a game where there are even chances of winning and losing and an infinite prize to be won.

This is conclusive and if men are capable of any truth this is it.

Images of The Wager—Original Fragment (Infini-rien)

-

See original images at the end of this paper.↩︎

-

Maybe take a moment to lay out the decision matrix.↩︎

-

Pascal’s expression for “heads or tails” is croix ou pile, meaning “cross or stack”; the modern French expression is pile ou face.↩︎

-

As soon as the bets are placed, the players no longer have a claim to their stake; it becomes part of the pot to be awarded to the winner.↩︎

-

That is, nothing in the physical makeup of the coin makes it tend one way or the other.↩︎

-

Another way to say this is that outcomes of small sample sizes do not represent true probabilities. It’s easy to flip a coin and have it come up heads twice in a row. It’s impossible to flip a coin a million times in a row and not have the number of heads be very very close to the number of tails.↩︎

-

There’s an old joke among professional gamblers that goes like this: suppose you flip a coin ten times, and it comes up heads ten times in a row, gamblers will react in three different ways:

-

The inexperienced gambler says, “the next flip is more likely to result in tails, since tails is due to come after all those heads,”

-

The experienced gambler says, “the past has no effect on the future, and therefore the next flip is just as likely to result in heads as tails,”

-

The professional gambler says, “Lemme see that coin…”

-

-

Note that Bob will never lose exactly $0.50 on any given flip, that’s impossible; but this is the average that will be approached as the number of flips increases.↩︎

-

Your handout has the entire passage, broken down into numbered quotations to which I will refer.↩︎

-

Note that not every two-outcome event has outcomes with equal chances, e.g., sporting events. This has been a traditional target for objectors to Pascal’s argument here, but since he says that we cannot reason to God’s existence, it is no different from a coin flip in terms of event odds.↩︎

-

What sort of believer? Catholic? Jansenist? Orthodox? Muslim? Jew? A common objection to Pascal’s approach is known as the ‘many gods’’ objection. But Pascal tells us what a life of belief looks like in this context: those taking up the affirmative side of the wager “behave just as if they did believe, taking holy water, having masses said, and so on.” Clearly his argument is meant for a rather narrow audience: a contemporary French baptized (but lapsed) Catholic. Presumably this sort of life would also involve giving up what he later calls “noxious pleasures” (presumably drinking, chasing girls, and perhaps even gambling.↩︎

-

Remember that EV-neutral means that it is breakeven in the long run.↩︎

-

Note that this is where Pascal reminds us that the wisdom of the gambler makes it “right” to play when the money odds exceed the event odds by the smallest unit, i.e., 3 : 1 money odds on an coin flip event which presents 2 : 1 event odds. And he puts it in even stronger terms by saying “you would be acting wrongly” (meaning against the principles of the gambler) if you were to refuse such a bet. All the more must the gambler play when the odds increase from 3 : 1 to anything greater than 3, all the way up to infinity.↩︎

-

It could be useful to explain the Martingale betting system and its failure to guarantee no loss.↩︎

-

Now, in reality, there does not have to be such a high number of events of the same kind, there just must be some future events.↩︎

-

Bob is very wealthy from business, and can afford to wager millions.↩︎

| Receive lectures and talks via podcast! | ||||

|---|---|---|---|---|