- Home

-

About

Fidelity & Excellence

Fidelity & ExcellenceThomas Aquinas College is unique among American colleges and universities, offering a faithfully Catholic education comprised entirely of the Great Books and classroom discussions.

-

A Liberating Education

Truth Matters

Truth MattersTruth, and nothing less, sets men free; and because truth is both natural and supernatural, the College’s curriculum aims at both natural and divine wisdom.

-

A Catholic Life

Under the Light of Faith

Under the Light of FaithThe intellectual tradition and moral teachings of the Catholic Church infuse the whole life of Thomas Aquinas College, illuminating the curriculum and the community alike.

-

Admission & Aid

Is TAC Right for You?

Is TAC Right for You?Do you enjoy grappling with complex questions? Are you willing to engage in discussions about difficult concepts, with the truth as your ultimate goal?

-

Students & Parents

Mind, Body & Spirit

Mind, Body & SpiritThere is always something to do at TAC — something worthwhile, something fulfilling, and something geared toward ever-greater spiritual and intellectual growth.

-

Alumni & Careers

What Can You Do with a Liberal Education?

What Can You Do with a Liberal Education?Nothing speaks more to the versatility of the College’s academic program than the good that our alumni are doing throughout the Church and the world.

- Search

- Giving

Making Education Affordable

College Freezes Tuition Costs, Limits Student Loan Debt

To help ease the financial burden on students and their parents in a weak economy, the Thomas Aquinas College Board of Governors has frozen the cost of tuition and room & board for the 2015-2016 academic year. Tuition will remain at $24,500, and room & board at $7,950, bringing the total cost of attendance — including books and all fees — to $32,450. That amount is well below the average of $37,948 for private institutions in the Western United States, according to The College Board’s Annual Survey of Colleges (2013-2014).

“In the midst of trying economic times, we are determined to make college as viable for our undergraduates as we can,” says Thomas Aquinas College President Michael F. McLean. “We are committed to being good stewards of the funds our benefactors give us for the benefit of our students.”

In order to keep its unique program of Catholic liberal education within the reach of all motivated students and their families, the College additionally maintains a robust financial aid program. No student is ever turned away on the basis of financial need, and the College maintains several policies — academic as well as financial — that help spare students from incurring excessive loan debt. Over the last few months these policies have garnered a fair amount of media attention, in both the Catholic and the secular press.

Debt Reduction

“We think it’s terrible how much students have to borrow at many other schools,” Director of Financial Aid Greg Becher recently told The Catholic Times. “So we have two things we’re doing here at Thomas Aquinas College.” In an interview with the diocesan newspaper, which serves the faithful of La Crosse, Wisconsin, Mr. Becher discussed how the College is able to minimize student debt loads. According to the 2013-2014 Common Data Set, a data source used by most college surveys, members of the Thomas Aquinas Class of 2013 graduated with an average college loan debt of just $15,521 — about half the national average of $29,400.

“First, we limit the amount students have to borrow before they can receive institutional aid — such as work study or a grant from the College,” Mr. Becher explained. The College asks financial aid students to help bear the cost of their education by taking on no more than $18,000 in loans over four years. “Many other schools will maximize the student loan before they provide institutionally.”

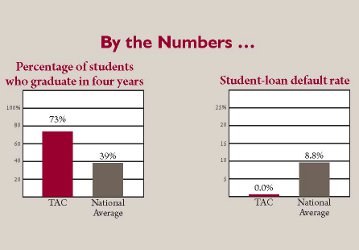

Second, “Thomas Aquinas College has a fixed curriculum, and most students finish in four years,” added Mr. Becher. “That itself limits the amount students have to borrow and the amount parents have to pay for tuition.”

Nationwide, just 39 percent of American college students graduate in four years, compared to 73 percent of the students at Thomas Aquinas College. As a result, the total cost of education at a typical public or private college — even if its tuition rate is nominally lower than the College’s — is oftentimes higher, because students must pay for 2-4 additional semesters. (This delay also comes with the opportunity cost of missed time in the workforce after graduation.) According to the California Student Aid Commission, Thomas Aquinas College alumni have a 0 percent default rate on their student loans, compared to a nationwide average default rate of 8.8 percent.

Best College Value

Notably, Thomas Aquinas College’s latest ranking on Kiplinger’s “Best College Values” list rose to No. 30 in the nation, up from No. 41 just a year ago. A likely explanation for this jump is that, for the first time, Kiplinger now measures four-year graduation rates. “That change penalizes schools with a high percentage of students that graduate in five or six years, but it’s based on simple math,” wrote Sandra Block, senior associate editor for Kiplinger’s Personal Finance. “The faster your child graduates, the less money you’ll spend on his or her education.”

“We don’t want to burden students with an unusually large amount of debt after graduation,” said Mr. Becher. “We want them to be productive members in their communities, not hampered in their job decisions by a large amount of debt, and not burdened if they decide to marry or go on to the religious life with difficult amounts to re-pay. By God’s grace, and thanks to the generosity of many benefactors, we are able to do just that.”